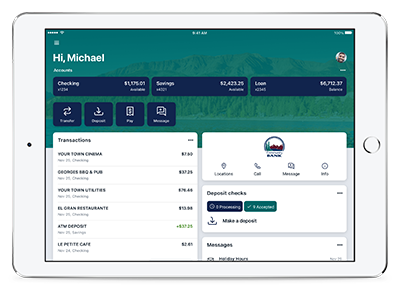

Experience the Ease of Digital Banking

Manage your Community Bank accounts day or night with our Digital Banking service.

Banking has never been easier - or more secure!

Digital Banking Key Features

- Organize your accounts consistently across all devices - phone, tablet or computer.

- Keep your account protected with enhanced security via two-factor authentication.

- Communicate with a Customer Service Representative using our secure messaging feature (during regular business hours).

- Manage a number of banking activities anytime at home or on the go:

- View balances and account activity.

- Make deposits using your mobile device.

- Pay bills.

- Transfer funds between your accounts.

- Turn your Community Bank debit card on or off if lost or stolen.

Receive Your Monthly Statement Electronically

Access your monthly bank statements from your Community Bank Digital Banking login. No more hassle of waiting for your statement to arrive in the mail each month, we'll notify you once your eStatements are available.

You must have Community Bank Digital Banking to receive eStatements.

eStatement Benefits

- View your monthly bank statements with ease

- Receive an automatic email once your monthly eStatement is available

- eStatements are saved as a PDF which you can access, save and print as needed

- Up to 18 months of eStatements and notices are archived within your Digital Banking account

How to Enroll in eStatements

- Login to your Digital Banking account

- Select the account you wish to receive eStatements for

- Click the "Documents" action button

- Click "Enroll" and follow the on-screen prompts

Pay Bills Online

Pay your bills without the hassle of writing and mailing checks each month. You are able to pay individuals or businesses within the United States. Schedule recurring payments like your monthly phone or internet bill. It's simple and secure.

- Login to your Digital Banking account

- From the account dashboard, select "Pay A Bill"

- Follow the on screen prompts to set up your first payment

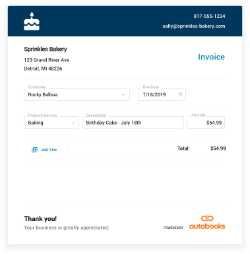

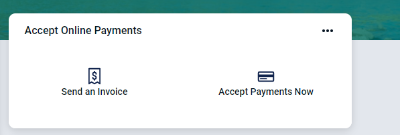

Accept Online Payments with Autobooks

Autobooks is designed specifically for small business owners that don't have time for complicated systems. Sign up for Autobooks to easily manage your invoicing.

- Send Invoices - Create and send a professional invoice to your customer's inbox. Delight your customers with easy online payment options. You’ll be able to see who paid their invoice and who is past due.

- Payments Go Right Into Your Business Checking Account - In just a few clicks, your customers pay you with their debit card, credit card or an electronic bank transfer.

- Payment Activity - Quickly see who opened your invoices, who made a payment and who still owes you money. You can also access more detailed reports, such as Balance Sheets or General Ledgers.

- Live Support to help you every step of the way

- Only Pay When You Accept A Payment - The rate for card-based transactions is 3.49%. The rate for ACH-based transactions is 1%.

Check to see if Autobooks can save you money!

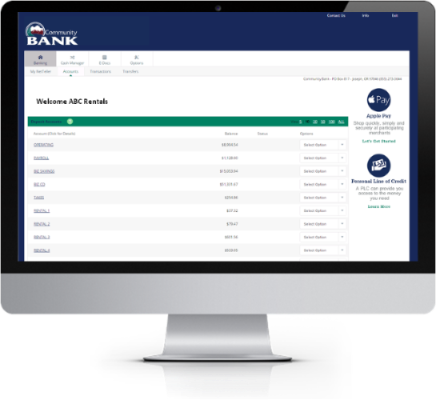

Cash Management

Community Bank Online Cash Management provides business customers with comprehensive account management and payment capabilities.

Account Management

- See all your accounts in one place — checking, savings, loans, and more

- Delegate access to trusted users — like an accountant or bookkeeper

- Monitor account activity and up to 180 days of transaction history

- Transfer funds between your accounts

- View, print and download statements and check images

Payment Features

Add any of the following services you wish to utilize within Digital Banking:

- Originate payroll or business payments via Automated Clearing House (ACH)

- Pay bills

- Execute wire transfers

- Make tax payments with link to EFTPS

Cost

There is no monthly access fee for Cash Management. Payment services are additional:

- $30.00 monthly fee for ACH services

- $5.00 for each ACH file originated

- $5.00 for each returned ACH item (account closed or incorrect number input)

- $30.00 for each wire entered and processed

- There is no fee for E-Docs to receive and review statements

What is Digital Banking? Is There a Fee?

Digital Banking allows our customers a secure and convenient way to access their Community Bank accounts at home or on the go. There are no fees to access Digital Banking.

Enrolling in Digital Banking

You can enroll in Digital Banking by clicking here or contacting your local branch.

Two Factor Authentication

What is two-factor authentication (2FA)?

Two-factor authentication is a security feature that adds an additional layer of security to your accounts by requiring additional login credentials beyond your username and password. All Digital Banking users are required to establish a 2FA method to ensure accounts are secure.

Two-factor authentication is a security feature that adds an additional layer of security to your accounts by requiring additional login credentials beyond your username and password. All Digital Banking users are required to establish a 2FA method to ensure accounts are secure.

How do I enable two-factor authentication?

You will need to enroll with an email address and mobile phone number. Once this information has been entered, you’ll be prompted to select your preferred method of verification.

You will need to enroll with an email address and mobile phone number. Once this information has been entered, you’ll be prompted to select your preferred method of verification.

- Code sent to you via text message

- Automated phone call

- Code received via Authenticator App (Authy)

After entering the verification code, if you are logging in from a secure computer, you have the option to select “Don’t ask for code again on this computer.” This option should never be selected on a shared or public computer.

What should I do if I did not receive a Verification Code?

Ensure the phone number you entered is correct. If it needs to be changed, contact our customer service team at (800) 472-4292.

Ensure the phone number you entered is correct. If it needs to be changed, contact our customer service team at (800) 472-4292.

How long are the verification codes valid?

Codes will expire within three to six minutes.

Codes will expire within three to six minutes.

What if I entered the wrong verification code?

If too many attempts are made with an incorrect verification code you will be locked out of your account (five attempts in a single hour). There is no manual reset for this; you will need to wait an hour to try again. If you make more than five unsuccessful attempts in a 24-hour period, your login will be “suspended” and you will not be able to attempt for an additional 24-hours. If you have questions or need assistance please contact our customer service team at (800) 472-4292.

If too many attempts are made with an incorrect verification code you will be locked out of your account (five attempts in a single hour). There is no manual reset for this; you will need to wait an hour to try again. If you make more than five unsuccessful attempts in a 24-hour period, your login will be “suspended” and you will not be able to attempt for an additional 24-hours. If you have questions or need assistance please contact our customer service team at (800) 472-4292.

Why am I being prompted for a verification code if I selected "Remember this Computer?"

There are multiple reasons this may be happening:

There are multiple reasons this may be happening:

- If you log in using a different browser

- If you deleted your browser history

- If you have your browser settings set to delete cookies and history automatically

Can I reset my two-factor authentication method?

You can reset your 2FA method

You can reset your 2FA method

- Click your user profile

- Select Settings

- Select Security

- Under verification method, select 2-Step verification

Managing my Digital Banking Account Access

How do I reset my password?

Online:

Online:

- From the menu bar select your user profile

- Select Settings

- Select Security

- Under the password section click “Edit”

Digital App:

- From the menu bar select your profile

- Select Settings

- Select Security

- Select “Change Password”

What happens if I forget my password?

You are allowed 3 attempts to enter the correct password before your account will be locked. If you cannot remember your password you can click the "Forgot" button on the login screen. You may also call your local branch or (800) 472-4292 and we will happily assist you.

You are allowed 3 attempts to enter the correct password before your account will be locked. If you cannot remember your password you can click the "Forgot" button on the login screen. You may also call your local branch or (800) 472-4292 and we will happily assist you.

Will I be automatically signed out of Digital Banking?

- If you are accessing Digital Banking from a computer or desktop, you will be automatically signed out after 10 minutes of inactivity.

- If you are accessing Digital Banking from a mobile device, you will be automatically signed out once you swipe or close the app. Each time you access your app, you will be required to enter your passcode or utilize a form of biometric authentication (Face or Touch ID) to log in again.

How do I sign out of Digital Banking?

From the menu bar select your user profile

Select “Sign Out”

The system says 'Your Account is Currently Locked' when I try to log into Digital Banking?

As a security measure, accounts will lock for several reasons, such as inactivity or the incorrect password being entered multiple times in a row. If your account is locked, please contact your local branch, or (800) 472-4292 during regular business hours. Upon proper identification, we will be happy to unlock the account. This is for the security of our customers. We apologize for any inconvenience.

Browser Compatibility

What kind of browser do I need?

To support the security measures we put in place to keep your data safe, we require the use of a modern browser. As new versions of browsers are released, we will deprecate support for older versions. At this time, the most recent version of the browsers below are supported:

- Microsoft Edge

- Google Chrome

- Firefox

- Apple Safari

Number of Transfers I Can Make

Are there limits on the number of transfers I can make?

Yes, depending on the type of account you have. Some accounts, such as checking accounts, have no limits on the number of transfers a client can make. However, savings accounts, per your account agreement, are allowed no more than six electronic transfers per month.

Yes, depending on the type of account you have. Some accounts, such as checking accounts, have no limits on the number of transfers a client can make. However, savings accounts, per your account agreement, are allowed no more than six electronic transfers per month.

Downloading feature

What does the downloading feature do?

The download option allows you to download your transactions and/or payment schedule (Bill Pay users) into a spreadsheet or financial software like QuickBooks.

The download option allows you to download your transactions and/or payment schedule (Bill Pay users) into a spreadsheet or financial software like QuickBooks.

Keeping my Information Secure

What can I do to keep my information secure?

There are several things you can do to protect your Identification and password.

There are several things you can do to protect your Identification and password.

- Do not use an obvious number or other accessible information for your Digital Banking ID or password.

- Do not open emails or click on links from unknown senders.

- Verify emails from known senders prior to clicking on links (email compromise is the most prominent form of cyber attack).

- Ensure no one is watching when you enter your Digital Banking ID and password.

- Try to memorize your Digital Banking ID and password rather than writing them down.

- If you record your Digital Banking ID and password, store the document in a secure place.

- Do not share your Digital Banking ID and password with others. Nobody needs this information except YOU.

- Report any unusual account activity immediately.

- Do not give your personal information to anyone requesting it over the phone unless you have initiated the call.

- Always log out of the system.

Autobooks

Do I have to download any software to use Autobooks?

No downloads of any kind are required. The Send Invoices and Accept Payment modules live completely inside of your digital banking.

Is there a fee?

Each time you accept a payment, there will be a transaction fee. The rate for card-based transactions is 2.89%. The rate for ACH-based transactions is 1%. You also have an option to upgrade the solution to include accounting and reporting. When you upgrade, you opt into a $10/month fee.

How do I sign up to try it?

You can enroll right inside of digital banking by clicking on the module to get started. If you need assistance, you can also contact the Autobooks team at Support@autobooks.co.

What is Send Invoices?

Send Invoices is a module that allows you to send an invoice to a customer, and collect payment electronically (credit card, debit card, bank transfer) for that invoice.

What is Accept Payments Now?

Accept Payments Now is a module that provides you with a unique payment link. This payment link leads to a payment form (displayed in a secure web browser). Your customers (or donors, if you have a non-profit organization) complete the form to send you a payment (or donation) electronically. This module is perfect for those businesses that need a flexible way to accept payments from customers, yet don’t create invoices.

Who are the Send Invoice and Accept Payments modules for?

The following types of businesses are great fits:

- Any business that sends a bill/invoice for its product or service.

- Service based businesses.

- Non-profits seeking to collect donations online.

What if I have additional questions?

Email the Autobooks team any time at Support@autobooks.co or call them between 9 a.m. and 6 p.m. Eastern time at 866-617-3122.

AT COMMUNITY BANK, WE ARE