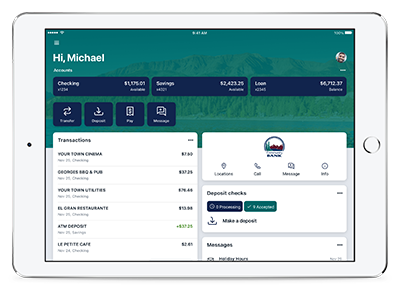

Experience the Ease of Digital Banking

Manage your Community Bank accounts day or night with our Digital Banking service.

Banking has never been easier - or more secure!

Digital Banking Key Features

- Organize your accounts consistently across all devices - phone, tablet or computer.

- Keep your account protected with enhanced security via two-factor authentication.

- Communicate with a Customer Service Representative using our secure messaging feature (during regular business hours).

- Manage a number of banking activities anytime at home or on the go:

- View balances and account activity.

- Make deposits using your mobile device.

- Pay bills.

- Send money to friends and family.

- Transfer funds between your accounts.

- Turn your Community Bank debit card on or off if lost or stolen.

Receive Your Monthly Statement Electronically

Access your monthly bank statements from your Community Bank Digital Banking login. No more hassle of waiting for your statement to arrive in the mail each month, we'll notify you once your eStatements are available.

You must have Community Bank Digital Banking to receive eStatements.

eStatement Benefits

- View your monthly bank statements with ease

- Receive an automatic email once your monthly eStatement is available

- eStatements are saved as a PDF which you can access, save and print as needed

- Up to 18 months of eStatements and notices are archived within your Digital Banking account

How to Enroll in eStatements

- Login to your Digital Banking account

- Select the account you wish to receive eStatements for

- Click the "Documents" action button

- Click "Enroll" and follow the on-screen prompts

Pay Bills Online

Pay your bills without the hassle of writing and mailing checks each month. You are able to pay individuals or businesses within the United States. Schedule recurring payments like your monthly phone or internet bill. It's simple and secure.

To begin making payments online:

- Login to your Digital Banking account

- From the account dashboard, select "Pay A Bill"

- Follow the on screen prompts to set up your first payment

Login to Digital Banking to get started.

What is Digital Banking? Is there a fee?

Digital Banking allows our customers a secure and convenient way to access their Community Bank accounts at home or on the go. There are no fees to access Digital Banking.

Enrolling in Digital Banking

You can enroll in Digital Banking by clicking here or contacting your local branch.

Two Factor Authentication

What is two-factor authentication (2FA)?

Two-factor authentication is a security feature that adds an additional layer of security to your accounts by requiring additional login credentials beyond your username and password. All Digital Banking users are required to establish a 2FA method to ensure accounts are secure.

Two-factor authentication is a security feature that adds an additional layer of security to your accounts by requiring additional login credentials beyond your username and password. All Digital Banking users are required to establish a 2FA method to ensure accounts are secure.

How do I enable two-factor authentication?

You will need to enroll with an email address and mobile phone number. Once this information has been entered, you’ll be prompted to select your preferred method of verification.

- Code sent to you via text message

- Automated phone call

- Code received via Authenticator App (Authy)

After entering the verification code, if you are logging in from a secure computer, you have the option to select “Don’t ask for code again on this computer.” This option should never be selected on a shared or public computer.

What should I do if I did not receive a Verification Code?

Ensure the phone number you entered is correct. If it needs to be changed, contact our customer service team at (800) 472-4292.

Ensure the phone number you entered is correct. If it needs to be changed, contact our customer service team at (800) 472-4292.

How long are the verification codes valid?

Codes will expire within three to six minutes.

What if I entered the wrong verification code?

What if I entered the wrong verification code?

If too many attempts are made with an incorrect verification code you will be locked out of your account (five attempts in a single hour). There is no manual reset for this; you will need to wait an hour to try again. If you make more than five unsuccessful attempts in a 24-hour period, your login will be “suspended” and you will not be able to attempt for an additional 24-hours. If you have questions or need assistance please contact our customer service team at (800) 472-4292.

Why am I being prompted for a verification code if I selected "Remember this Computer?"

Why am I being prompted for a verification code if I selected "Remember this Computer?"

There are multiple reasons this may be happening:

- If you log in using a different browser

- If you deleted your browser history

- If you have your browser settings set to delete cookies and history automatically

Can I reset my two-factor authentication method?

You can reset your 2FA method

- Click your user profile

- Select Settings

- Select Security

- Under verification method, select 2-Step verification

Managing my Digital Banking Account Access

How do I reset my password?

Online:

- From the menu bar select your user profile

- Select Settings

- Select Security

- Under the password section click “Edit”

Digital App

- From the menu bar select your profile

- Select Settings

- Select Security

- Select “Change Password”

You are allowed 3 attempts to enter the correct password before your account will be locked. If you cannot remember your password you can click the "Forgot" button on the login screen. You may also call (800) 472-4292 and we will happily assist you.

Will I be automatically signed out of Digital Banking?- If you are accessing Digital Banking from a computer or desktop, you will be automatically signed out after 10 minutes of inactivity.

- If you are accessing Digital Banking from a mobile device, you will be automatically signed out once you swipe or close the app. Each time you access your app, you will be required to enter your passcode or utilize a form of biometric authentication (Face or Touch ID) to log in again.

- From the menu bar select your user profile

- Select “Sign Out”

As a security measure, accounts will lock for several reasons, such as inactivity or the incorrect password being entered multiple times in a row. If your account is locked, please call (800) 472-4292 during regular business hours. Upon proper identification, we will be happy to unlock the account. This is for the security of our customers. We apologize for any inconvenience.

Browser

What kind of browser do I need?

To support the security measures we put in place to keep your data safe, we require the use of a modern browser. As new versions of browsers are released, we will deprecate support for older versions. At this time, the most recent version of the browsers below are supported:

- Microsoft Edge

- Google Chrome

- Firefox

- Apple Safari

Number of transfers I can make

Are there limits on the number of transfers I can make?

Yes, depending on the type of account you have. Some accounts, such as checking accounts, have no limits on the number of transfers a client can make. However, savings accounts, per your account agreement, are allowed no more than six electronic transfers per month.

Yes, depending on the type of account you have. Some accounts, such as checking accounts, have no limits on the number of transfers a client can make. However, savings accounts, per your account agreement, are allowed no more than six electronic transfers per month.

Downloading feature

What does the downloading feature do?

The download option allows you to download your transactions and/or payment schedule (Bill Pay users) into a spreadsheet or financial software like QuickBooks.

The download option allows you to download your transactions and/or payment schedule (Bill Pay users) into a spreadsheet or financial software like QuickBooks.

Keeping my Information Secure

What can I do to keep my information secure?

There are several things you can do to protect your Identification and password.

There are several things you can do to protect your Identification and password.

- Do not use an obvious number or other accessible information for your Digital Banking ID or password.

- Do not open emails or click on links from unknown senders.

- Verify emails from known senders prior to clicking on links (email compromise is the most prominent form of cyber attack).

- Ensure no one is watching when you enter your Digital Banking ID and password.

- Try to memorize your Digital Banking ID and password rather than writing them down.

- If you record your Digital Banking ID and password, store the document in a secure place.

- Do not share your Digital Banking ID and password with others. Nobody needs this information except YOU.

- Report any unusual account activity immediately.

- Do not give your personal information to anyone requesting it over the phone unless you have initiated the call.

- Always log out of the system.

AT COMMUNITY BANK, WE ARE